Finally, after much consideration, I have decided to sell my last Unit Trust Regular Saving Plan (RSP) Fund. I don’t think it is suitable with my financial goals. Firstly, I like to see dividend rolling into my account (preferably on a yearly basis) and secondly, I don’t like paying the 3% sales charge anymore (and 1.8% management fees too). In the long run it just eats up on my capital and the return is not that good. One post that I saw on IG made me realize that. Do follow my IG below if you like to see me sharing random inspiring IG stories from others!

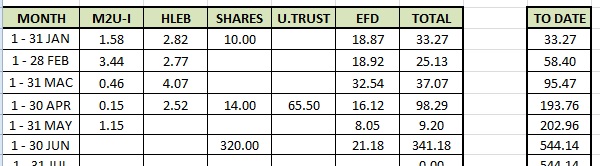

Anyway, here’s a summary of my UT investment since 2015.

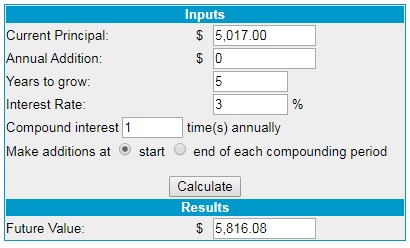

Considering the market outlook, I should be thankful I didn’t lose any capital. But like I said before, the return is not good. If I were to put the same amount into eFD, I’ll get more than that. And that is just the minimum 3%. But then again, I don’t have 5k when I started to invest. That amount grow from a monthly deduction of between RM104 – RM125. This can be a good way to force us to save some money, I guess, as it will auto-deduct from your account. Kinda like save and forget (and cannot touch too…)

I will use this fund to buy some dividend stocks to build my passive income one ringgit at a time. Happy investing…